Volume 2 of the Kent Economics Undergraduate Research Journal features contributions from 7 of the final year dissertation students from the class of 2023. These … Read more

Category: Research

Developing Youth Groups in Bangladesh to Support Peers at Risk of Early Marriage

Zaki Wahhaj is awarded a Global Innovation Fund grant, aiming to reach 50 communities across Bangladesh. Professor Zaki Wahhaj is part of an international team … Read more

School of Economics Research Scholarships 2023

The School has a thriving research community that you can be part of. Our staff produce world-class research, publish regularly in leading academic journals and foster generative research partnerships around the world. … Read more

The Musk effect

Stage 3 student Kheireddine Adeyemi is working on his dissertation -how Elon Musk’s Twitter activity effects financial markets. With Musk’s recent bid to acquire Twitter, … Read more

Kent Researchers work to improve access to Mobile Financial Services for the Poorest in Bangladesh

This Innovations for Poverty Action project aims to improve access to mobile phone financial services for financial transactions amongst Bangladesh’s vulnerable population. Dr Zaki Wahhaj, … Read more

September News RoundUp

The furlough scheme has come to an end, we’ve got no fuel and no-one to drive our lorries, but happiness reigns in the School of … Read more

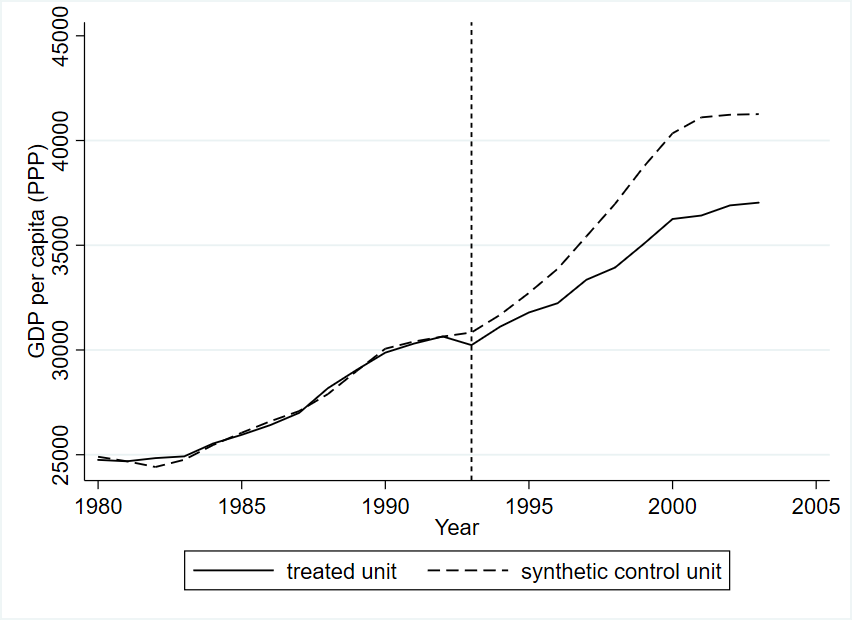

Federalism, but how? The impact of vertical fiscal imbalance on economic growth. Evidence from Belgium

A new paper published by Alessio Mitra, PhD candidate in Economics at Kent, shows how a how a fiscally unbalanced federal system can be used … Read more

Gschwandtner study considers the consumption of fruit and vegetables and doing exercise – on happiness.

Adelina Gschwandtner collaborates with Sarah Jewell and Uma Kambhampati on this paper, Lifestyle and Life Satisfaction: The Role of Delayed Gratifcation, accepted for publication in … Read more

North Thanet MP Visits to hear Funded Covid-19-related Research

UK Research and Innovation (UKRI) teamed up with the University of Kent to present funded COVID-19-related research to local MP Sir Roger Gale. Meeting In-Person, … Read more

July News RoundUp

July brought Finalists Celebrations and ‘Freedom Day’ -our research has been looking at the kind of economic climate our graduates will be entering. We celebrated … Read more