Dr Alfred Duncan and Professor Charles Nolan discuss Adam Smith’s vision for banking and try to deduce how Smith might have approached some current issues … Read more

Category: MaGHiC

Call for Papers: Firm Dynamics, Market Structures and Productivity in the Macroeconomy III

We are hosting the third edition of our workshop, this time a collaboration with joint with the Banks of England and Bristol University and invite … Read more

Breaking the bank: why removing interest on reserves would ‘tie one hand behind the back of the Bank of England’

As the Chancellor finds himself under pressure because of his £43bn tax-cutting programme, it is understood that the Treasury is weighing up a number of … Read more

Blowing the budget: why the Conservative mini-budget is so toxic

How should we interpret the U-turn on the abolition of the 45p rate for high income earners? ‘This is more a political move than one … Read more

Quantitative Tightening, Mandates and Expectations

The annual Money Macro and Finance conference, was hosted here at Kent with top current and former policymakers and academics speaking about the current global … Read more

The One About Inflation

The Macroeconomics, Growth and History Centre (MaGHiC) are excited to welcome more than a hundred delegates on campus for the 53rd Annual MMF Conference on … Read more

Trade and volatility: Analysing the role of specialisation and diversification

Professor Miguel León-Ledesma has collaborated with Laura Puzzello and Adina Ardelean, in this VoxEU column on the complex interaction between sectoral shocks, sectoral specialisation, and geographic diversification … Read more

Early Human Capital Accumulation and Decentralization

Recent Guy Tchuente research shows the importance of local knowledge in the provision of publicly financed goods. Dr Guy Tchuente‘s research is included in a … Read more

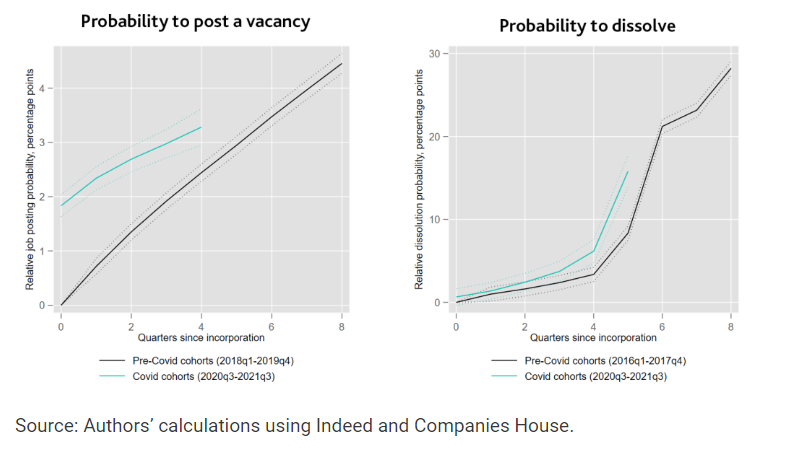

Booming entrepreneurship during the Covid-19 pandemic

Dr Anthony Savagar has collaborated with Saleem Bahaj from the Bank of England’s Research Hub and Sophie Piton who works in the Bank of England’s … Read more

Volatility and Trade

A new CEPR working paper by Professor Miguel Leon-Ledesma, collaborating with Adina Ardelean, and Laura Puzzello, studies how the structure of international trade affects macroeconomic … Read more