Volume 2 of the Kent Economics Undergraduate Research Journal features contributions from 7 of the final year dissertation students from the class of 2023. These … Read more

Category: Undergraduate

Three Heads Better than One!

(photograph: Amanda Gosling (left), Miguel León-Ledesma (right) Dr Amanda Gosling will step us as the next Head of Economics at Kent, taking over from Professor Miguel … Read more

Level up: A New Home For Economics in Sibson

Join us as we explore the excitement surrounding the School of Economics’ move to Sibson, as expressed by Dr. Alfred Duncan. Here at the School … Read more

Can You Work Part-Time and Get a Degree?

When people hear part-time work alongside a full-time university course, most respond “How? I could never!” with the assumption that it would be a distraction. … Read more

A Year in Economics

It couldn’t be a more important time to study economics. We’ve had a very productive year at the school, despite the pandemic, working on groundbreaking … Read more

July News RoundUp

July brought Finalists Celebrations and ‘Freedom Day’ -our research has been looking at the kind of economic climate our graduates will be entering. We celebrated … Read more

A Finalist Celebration!

On Friday 16 July, the School of Economics came together to celebrate our final year students in an event that reflected on their time at … Read more

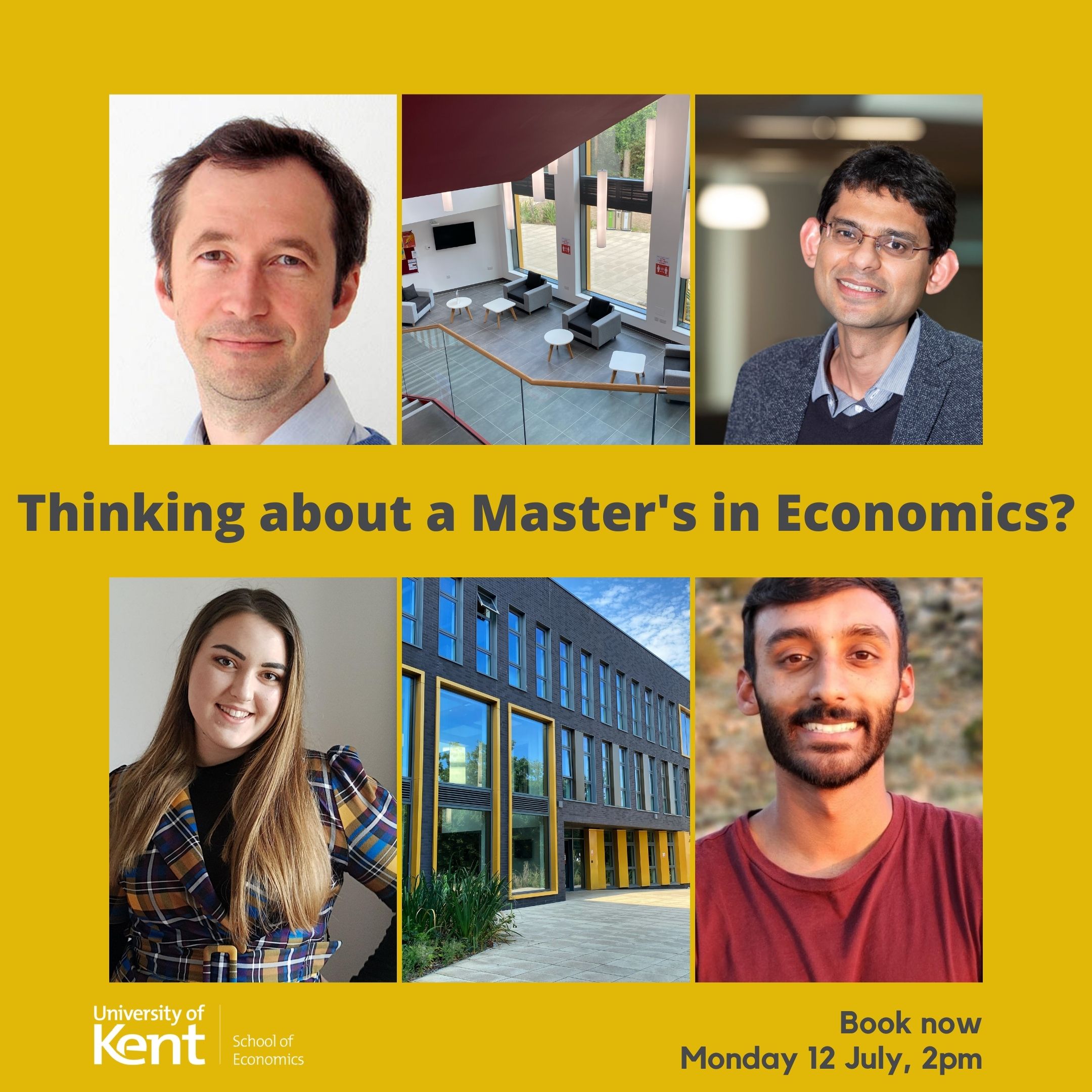

Thinking about a Master’s in Economics?

Event: Monday 12 July at 2pm on Zoom Are you considering a Master’s degree in Economics? Did you know that the School of Economics at … Read more

Student profile: Nick Hutchinson

Nick is in his final year of an Economics BSc degree at the University of Kent. What attracted you to study at Kent? One of … Read more

Academic Peer Mentoring Applications Are Open!

Do you remember your first few weeks at uni? Getting lost on campus, not knowing where to find your textbooks, or not knowing what events … Read more