Teale Cunningham was part of the first cohort of graduates on our Professional Economist Degree Apprenticeship Scheme and his dissertation has been chosen for inclusion … Read more

Gaining a Competitive Edge

Victoria Haigney was part of the first cohort of Professional Economist Degree Apprenticeship Scheme who gradauated with a first class honours in a celebration at … Read more

The Importance of Education

Tobin Lochrie was looking for a career change when he joined the Professional Economist Degree Apprentiship Progamme where he was apprenticed to the Department of … Read more

From Movie Nights to Industry Insights

Happy New Year from everyone here at the School of Economics! We caught up with Victoria Ng Wan Ying, a final year economics student, who … Read more

Call for Papers: Firm Dynamics, Market Structures and Productivity in the Macroeconomy III

We are hosting the third edition of our workshop, this time a collaboration with joint with the Banks of England and Bristol University and invite … Read more

Go Abroad: Bangladesh

In 2021 Kent signed a Memorandum of Agreement with BRAC University based in Dhaka, Bangladesh to allow for the co-supervision of students on Kent’s School … Read more

Remarkable Achievement as the first Professional Economist Degree Apprentices Graduate

Friday 24th November marked a historical moment in the University of Kent’s and the Government Economics Service’s apprenticeship delivery, as the first cohort of Professional … Read more

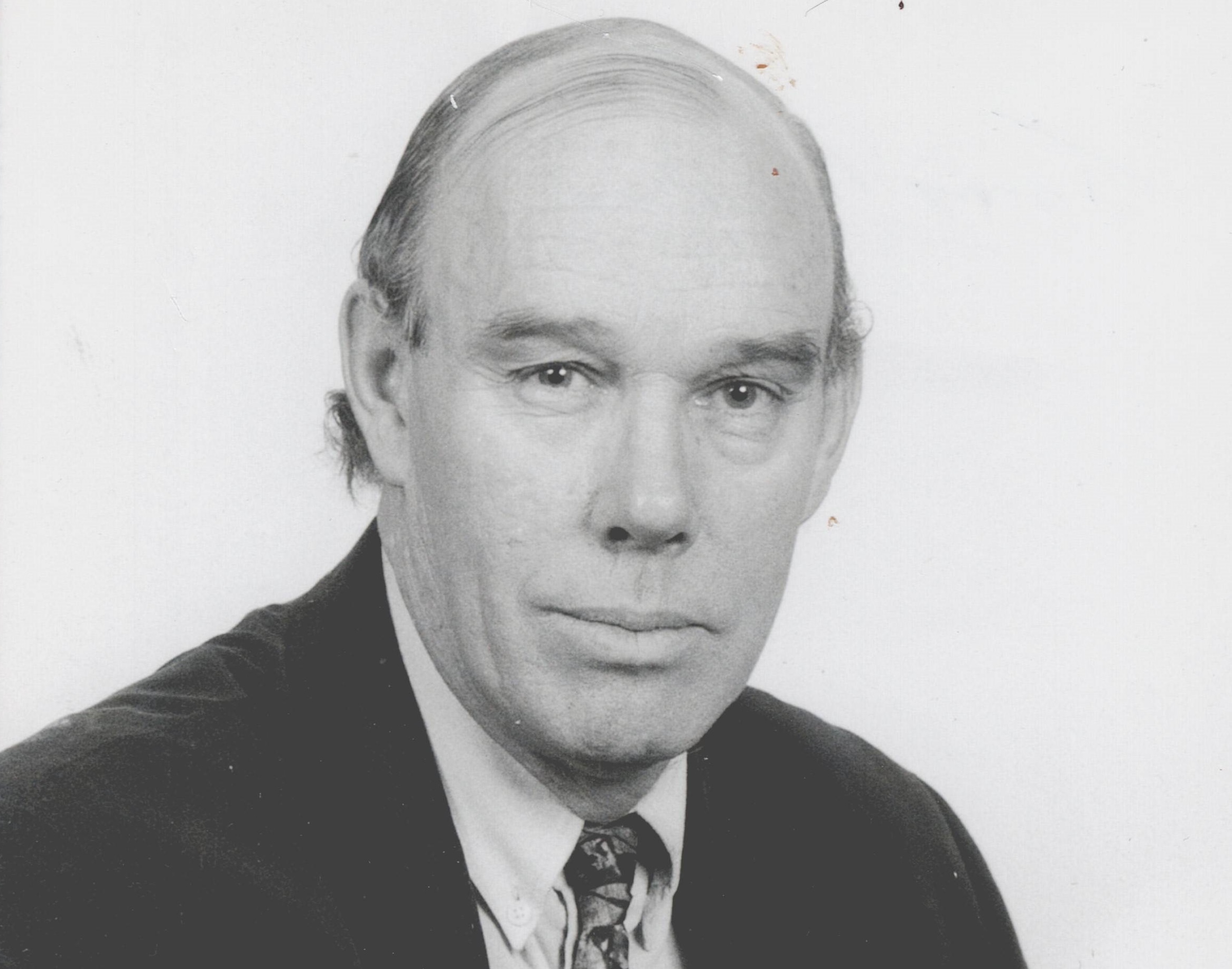

Professor Tony Thirlwall (1941 – 2023)

The life and academic journey of Tony Thirlwall were marked by a profound dedication and love of economic science, leaving an enduring legacy on ideas, … Read more

Developing Skills on a Year in Industry

Henna Patel chose to shake up the routine of seminars, lectures and her part time job by taking a Year in Industry at a paid … Read more

Kent Economics Research Seminars, Autumn Term 2023

Ali Sen (University of Cambridge) Structural Change at a Disaggregated Level: Sectoral Heterogeneity Matters Abstract: I analyze a disaggregated structural change model that takes into account the … Read more