This is the second part of the 10 most popular question related to weather derivatives. You can read the first part here. Read the questions and answers from 6-10.

This is the second part of the 10 most popular question related to weather derivatives. You can read the first part here. Read the questions and answers from 6-10.

6) Can you be more specific? Can you provide some examples?

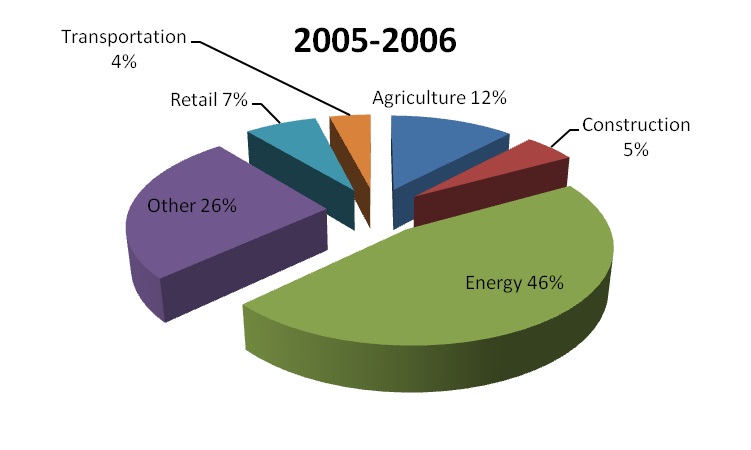

Energy companies are the main investors of the weather market. In 2004, the 69% of the weather market was consisting of energy companies. As more participants were entering the market, the energy companies were corresponding to 46% of the weather market in 2005.

Agricultural companies are greatly affected by weather conditions. However, only recently, companies from the agricultural sector started to participate in the weather market. Transportation, public utilities, retail sales, amusement and recreation services, and construction sectors are also very sensitive to weather.

It is clear that until 2005, the weather derivatives markets were dominated by energy companies. However, as weather derivatives gain popularity, new players enter the market especially from agriculture and retail sectors.

7) How Weather Derivatives are used? Can you give an example?

Weather can affect the revenues of a company directly by affecting the volume of sales. An amusement park that wants to hedge against rainy days in which fewer visitors will be attracted can enter a weather contract written on rainfall. Similarly, an electricity company that wants to avoid a reduced demand in electricity due to a warm winter can use a temperature derivative. A ski resort could use weather derivatives to hedge against a reduced snowfall which will attract fewer visitors. On the other hand, government organization can use weather derivatives in order to avoid an increase in the costs of cleaning roads in case of snowfall or icy days.

Weather can also affect the revenues or induce costs to the company indirectly, for example, a construction company that experiences delays when constructors cannot work due to weather. Similarly, cancellation of flights due to weather conditions can cause large costs to airlines.

8) What is the difference between Weather Derivatives and Weather Insurance?

A closer inspection of these two products reveals many differences. The first difference is the weather events that each tool covers. Insurance contracts are written on rare weather events such as extreme cold or heat and hurricanes or floods. These events are highly liked to create great catastrophes with huge impact on the revenues of the company. In contrast, weather derivatives can protect a company from recurrent weather conditions with large probability of occurrence. Unlike insurance and catastrophe-linked instruments, which cover high-risk and low-probability events, weather derivatives usually shield revenues against low-risk and high-probability events (e.g., mild or cold winters).

Claiming compensation from an insurance company usually is time consuming and expensive. The insured party must first prove that the weather had catastrophic effects on his company while the outcome depends on the subjective opinion of each regulator. On the other hand, in the case of weather derivatives, the company receives the profit of the contract immediately. In addition, there is no need for a catastrophe to occur on the company in order to receive the compensation. Weather derivatives are based on objective criteria like the index of the temperature, the rainfall, or any other underlying index which is accurately measured on a predefined weather station.

Another advantage of weather derivatives is the additional freedom that they offer to the buyer in contrast to the insurance contracts. Hedging the impact of the weather on the competitive companies using weather derivatives is possible. For example, an agricultural company on area A can hedge against weather effects in a different area B where a competitive company is established. Favorable weather conditions in area B will result to the increase of the quantity and quality of a particular agricultural product in area B. Consequently, the demand and price for this particular product from the company in area A will decrease.

Finally, since weather derivatives are financial instruments, a weather derivative can be later sold in a third party, for speculative reasons, before the expiration day of the contract.

9) Where Weather Derivatives are traded?

In September 1999, the Chicago Mercantile Exchange (CME) launched the first exchange-traded weather derivatives. CME’s contracts represent the first exchange-traded, temperature-based weather derivatives. The CME offers weather derivatives in 24 cities in the USA, 11 Europe, 6 in Canada, 3 in Australia and 3 in Japan.

10) What is the size of the market?

In 2004, the national value of CME weather derivatives was $2.2 billion and grew tenfold to $22 billion through September 2005, with open interest exceeding 300,000 and volume surpassing 630,000 contracts traded. However, the OTC market was still more active than the exchange, so the bid-ask spreads were quite large.

According to the annual survey by the Weather Risk Management Association, the estimated national value of weather derivatives – OTC and exchange-traded – traded in 2008/2009 was $15 billion, compared to $32 billion the previous year and $45 billion in 2005–2006. However, there was a significant growth compared to 2005 and 2004. According to CME, the recent decline reflected a shift from seasonal to monthly contracts.

Although the overall number of contracts decreased, following the general decline in financial markets, the weather market continues to develop, broadening its scope in terms of geography, client base, and interrelationship with other financial and insurance markets. In Asia, the number of contracts in 2009 rose to 250% compared to the period of 2007–2008. In Europe, there were 34,068 contracts traded in 2008–2009 compared to the previous year’s 25,290.

You can read the first part of this post here.

If you are interested in learning more about weather derivatives and the weather market you can start by reading: Alexandridis, A. and Zapranis, A. (2013). Weather Derivatives: Modeling and Pricing Weather-Related Risk. New York, USA: Springer.

If you have any more question leave them as comments and I’ll try to reply to them or gather them together and answer them in a new post.

I gotta favorite this website it seems extremely helpful invaluable.

For the current, small thesis I am working on concerning weather derivatives I am trying to find out what the current state of research is regarding weather derivatives. I am running short on time and while this section is not essential, I would need it for extra points. Could you please point me to one of your more recent works or maybe an article or paper of someone else, where I can find an overview over the current state of the field?

How does whether affect retail,agriculture,insurance,transport and energy?

Here are few examples. In a warm winter will consumers will ask for less energy for heating. Also, sales of warm clothing will be reduced. Similarly, strong winds will prevent ship and planes to deliver their products or snowfall can block train rails.