An international pensions risk report co-authored by, among others, Dr Pradip Tapadar and his PhD student Aniketh Pittea, has recently been jointly launched by the actuarial professional bodies.

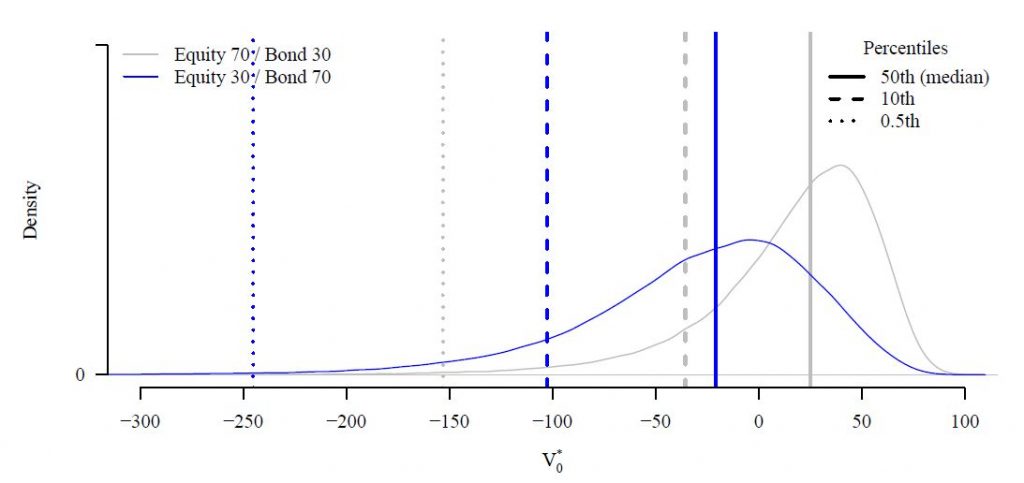

The research is a key output from a project entitled Population Ageing, Implications for Asset Values, and Impact for Pension Plans: An International Study and looked at Defined Benefit pension schemes using a hypothetical application of the economic capital requirements under a Solvency II framework. A key finding was that economic capital had a greater impact from changes in asset allocation than changes in contributions. It also highlights to pension plan sponsors and trustees that there is a large range of potential outcomes in a typical Defined Benefit pension scheme and could result in a significant variation in contributions to the plan. The research suggests that the range of outcomes can be narrowed by appropriate selection of asset allocation.

Pradip gave a talk in September based on this report at the Longevity 15 conference in Washington DC and will re-present on Wednesday 28 November, 11:00-13:00 in Keynes Lecture Theatre 3.

There’s more information about the report, and the option to download a copy, on the Institute and Faculty of Actuaries website.