I set up a trading club for students in response to what I saw as an unfulfilled demand, but found it more rewarding than I expected. On reflection, I see how important it is to help university students bridge the gap between theory and practice.

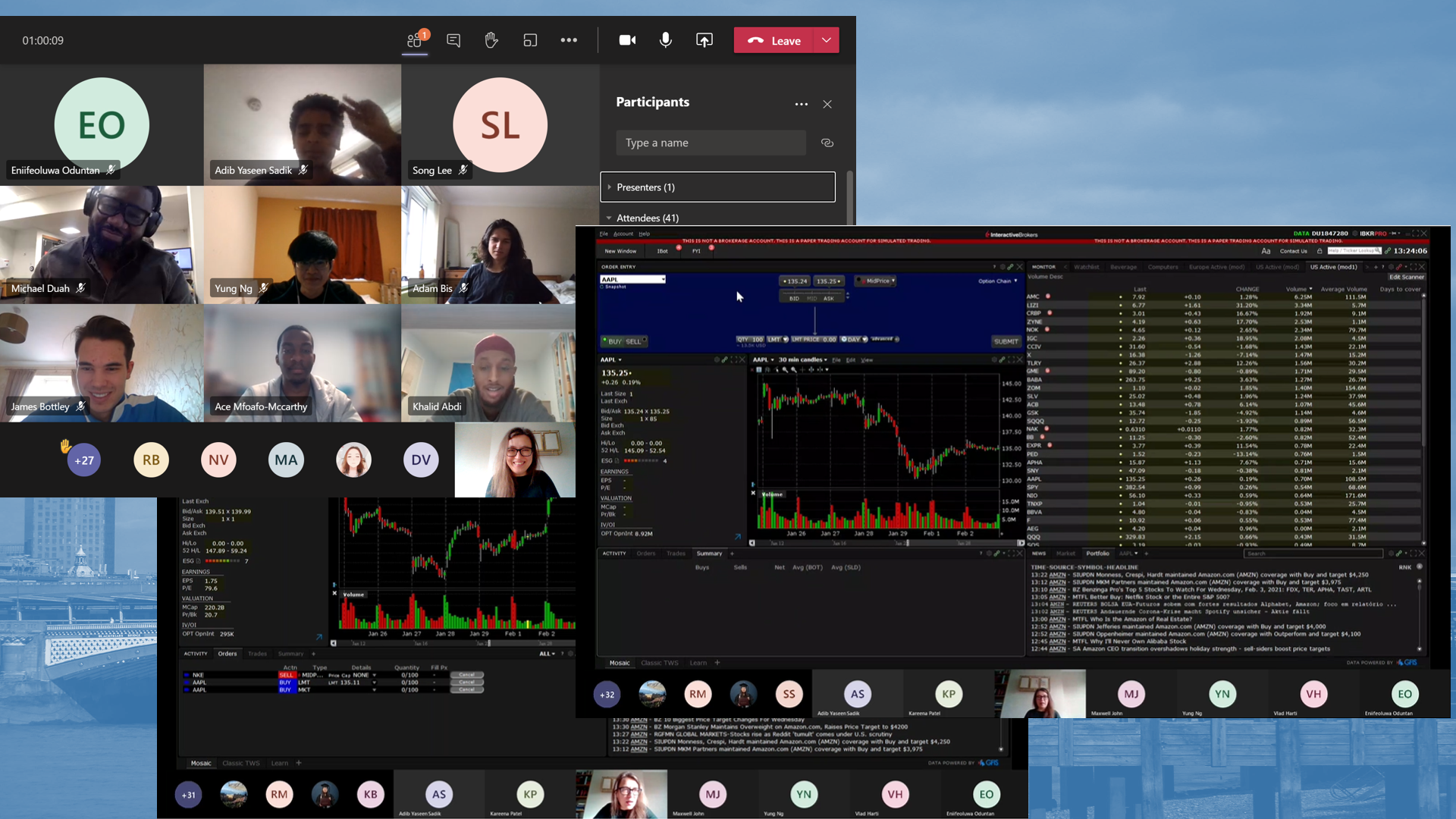

In 2019, I decided to set up the SMSAS Trading Club on a whim, as an open forum for regular student members to practise investment on a real-world trading platform (but with simulated money). Each student gets $1 million of ‘paper money’ to trade in a selection of stocks, commodities and derivatives. We meet weekly over the Spring term and discuss investment issues, research and practise taking actual positions, and sometimes bring in external speakers to talk about relevant topics. While I started this club as an experiment at first, it has proved truly fun and rewarding, not just for the students but for me personally. For one thing, it’s helped me think about how important it is to think creatively about incorporating experience in all my teaching.

As a lecturer teaching economics and finance subjects to mathematics and actuarial science students, I have always believed in placing my teaching firmly in the context of the world students see, or expect to work in. This is easier in some subjects than others – my macroeconomics or financial economics assignments and exam questions always incorporate at least one issue that’s in the news, making it easy for students to research it (and hopefully motivating them to continue to follow issues). However, for some concepts that appear straightforward in theory (e.g. short-selling), I found it particularly puzzling that even advanced students struggled to transfer what they learnt from one context to another.

When I set up the trading club, it was partly because some of the students would often talk to me about their interest in investment, yet find it challenging to translate the concepts I taught in my portfolio theory or financial derivatives class to the real world – as if the two were disconnected. While I often ask students to look up economic statistics from different sources as part of their economics assignments, I did not realize how critical this step of the ‘how to’ was, in helping students make their learning functional. In more technical subjects too, we really should be showing them ‘how to’ more often. Whether it is to short a stock or write an option – the connection between theory and practice is often not automatically formed!

The students who joined the club (with a maximum size of 40 members – sometimes flexed) are clearly self-motivated and interested in learning. Some place value on our initial demonstrations of navigating the trading platform, placing different types of trade orders, making use of information sources, and generally monitoring the portfolio. Others come to discuss the latest trends – you can imagine GME featured a lot this year. Some already trade on their own small portfolios using the new apps that are proliferating – they are happy to share their experiences (both gains and losses) with their colleagues, giving students a realistic idea of investment experience. It’s also useful to learn in a safe (costless) way that not all good ideas offer great rewards. What seems like a brilliant consensus investment one week could show up for all to see as a fat loss the next. Most importantly, though, it’s the act of doing that I think students value.

I will be thinking more about integrating more such challenges in my formal curriculum. Recently, there has been a lot of emphasis on apprenticeships and universities’ role in supporting them. I think we need also to think more seriously about experience for regular degree training.

[Note: SMSAS is the School of Mathematics, Statistics and Actuarial Science at the University of Kent, where I teach.]