“Empowering Poor Urban Women in Bangladesh through Digital Financial Services: Does Wage Payment via Mobile Money translate into Economic Empowerment?”

Dr Zaki Wahhaj, Reader in Economics, and Maliha Rahanaz, PhD student in Economics, have received a research grant from the WEE-DiFine (Women’s Economic Empowerment and Digitial Finance) initiative at the BRAC Institute of Governance and Development, BRAC University.

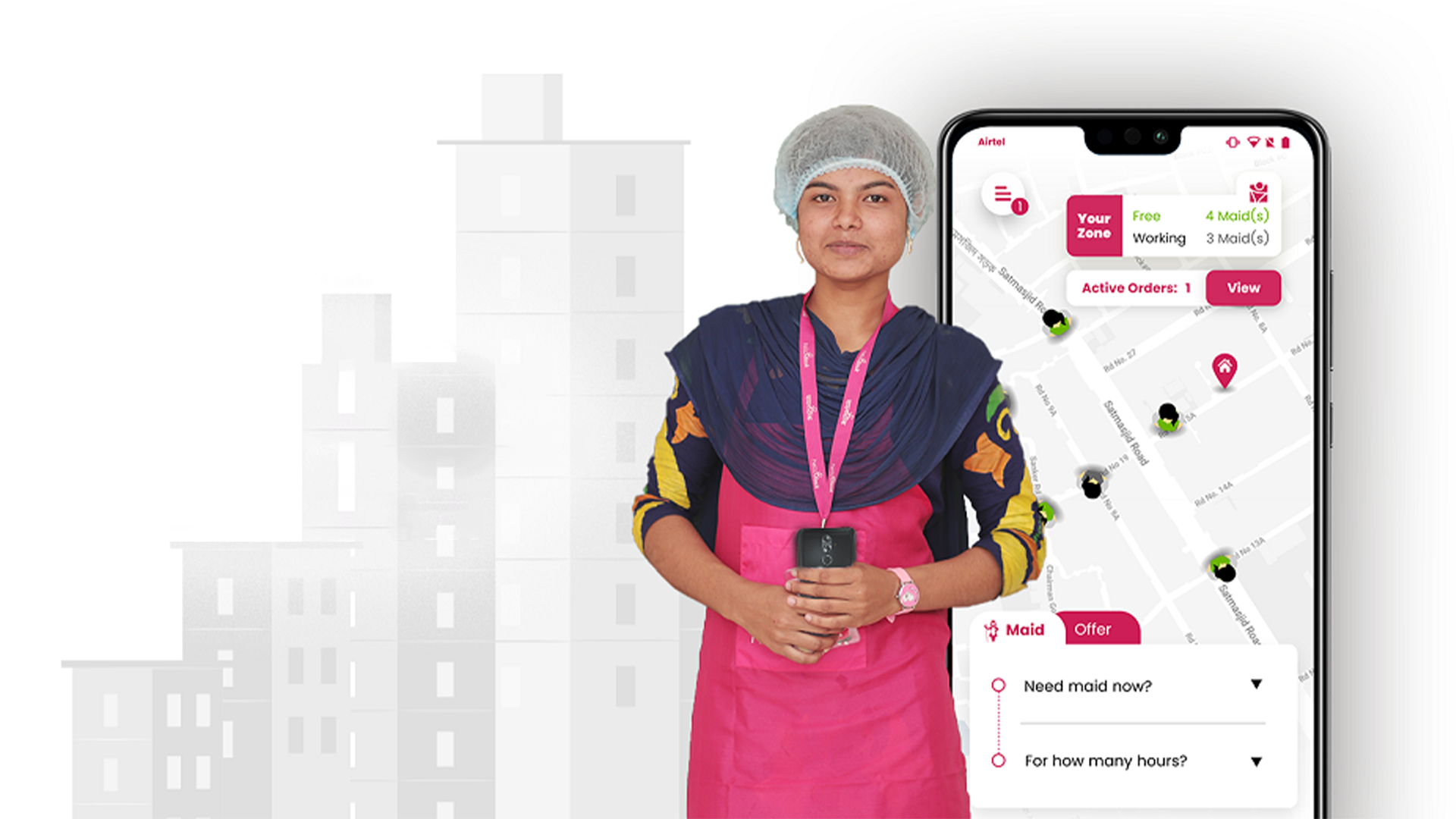

The award supports the project “Empowering Poor Urban Women in Bangladesh through Digital Financial Services: Does Wage Payment via Mobile Money translate into Economic Empowerment?” The project will involve collaboration with bKash, the largest mobile financial services provider in Bangladesh; HelloTask, a private sector organisation that operates a mobile app to match female domestic workers to work opportunities in Dhaka city; and DATA, a Dhaka-based research firm.

‘Female domestic workers lack formal employment contracts, have limited trade union representation and limited financial bargaining power at home. However, the majority of these women have access to a mobile phone’

The research project will address the question whether paying wages via mobile money affects the labour force participation and financial autonomy of low-income urban women in Bangladesh.

‘There has been a rapid increase in the use of digital financial services, such as mobile money, in developing countries,’ Wahhaj told us ‘particularly among the poor and marginalised who have traditionally had limited access to formal financial services. Carrying out day-to-day financial transactions digitally has the potential for improving the financial autonomy and economic participation of poor women.’ Opportunities for women’s participation in paid work have expanded in Bangladesh due to growth in the readymade garment industry and the service sector.

‘Female domestic workers constitute a sizeable fraction of urban women in paid work.’Rahanaz explains ‘Most lack formal employment contracts, have limited trade union representation and limited financial bargaining power at home. However, the majority of these women have access to a mobile phone and, thus, can potentially access and benefit from mobile financial services.’

Through a randomised intervention that involves a) wage payment via mobile money and b) training on the use of digital financial services to women employed in the domestic work sector in Dhaka, Bangladesh, the project will assess the advantages and risks involved in the use of digital financial services by low-skilled urban women in a developing country.

Further information about the project is available here.