Economics and Data Student Salvatore Ingenito looks at some of the effects of Brexit has had on the UK’s terms of trade, inflation and internal and external affairs.

As I write this, the World is facing numerous challenges: from sanctions against Russia after the invasion of Ukraine in February to the consequent increase in the cost of living in Europe and North America. Government bond markets are also predicting a recession, with 2 year interest rates exceeding 10 year interest rates. However, this blog won’t focus on global macroeconomic issues. Instead, it will focus on some of the effects that the withdrawal of the United Kingdom from the European Union has had on its economy and political spectrum. In particular, the impact that Brexit has had on the rise of the general price level and trade, as well as the hotly debated Northern Irish Protocol.

Currently, the Bank of England reports a 7% inflation rate (five percentage points above its 2% target) and an interest rate of 0.75%, expected to be increased by the MPC to 1% in May. Even someone with a poor economic background would understand things aren’t going well for the United Kingdom. Recently, the former policy maker and current president of the Peterson Institute of International Economics (PIIE) Adam Posen has stated, talking about the UK, “You run a trade war against yourself, bad things happen”. He and his team have estimated that about 80% of the reasons why the International Monetary Fund has predicted British inflation to remain high for longer than the other six members of the G7 is due to Brexit. In particular, Posen discussed how the end of the free movement since the 31st December 2020 has caused “a huge drop in migrant labour” causing a severe economic shock in terms of production and supply chain. Posen concludes suggesting a faster increase in the Bank of England BoE interest rate and to ease border bureaucracy in order to lower the price of food imports (Minister Rees-Mogg has planned a 4th delay in post-Brexit fresh food custom-checks).

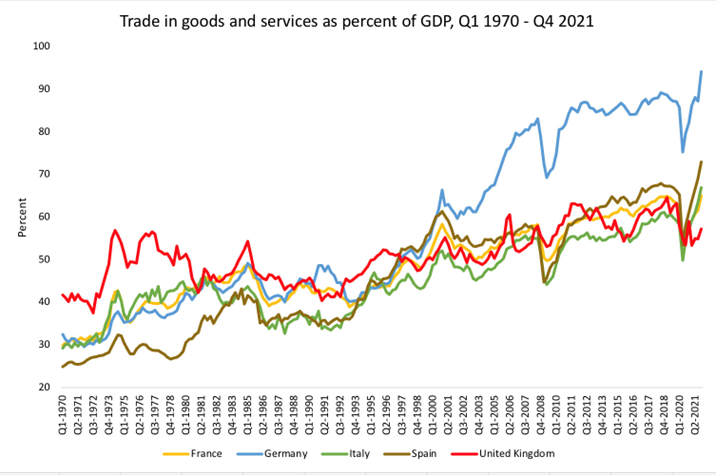

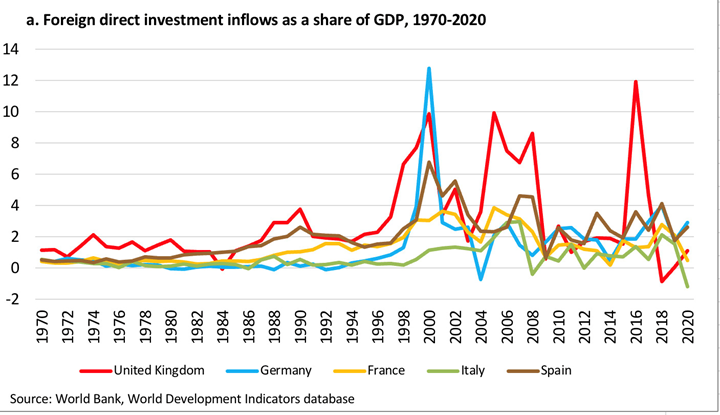

Moreover, an article by Lizzy Burden published on Bloomberg shows how Brexit trade difficulties (regulatory and border checks) have caused a 6% increase in food prices in the UK affecting especially low-income households. Additionally, the London School of Economics (LSE) has estimated that imports from the EU have fallen 25% so far. Also, since the end of the Transition Period, the amount of UK export relationships with EU firms has decreased by 30%. This has had major consequences on small businesses which have been forced to renounce export to the EU due to an increase in administrative costs (larger firms have been able to absorb the costs so far). It is also important to mention a study of the previously cited PIIE that depicts how the UK trade is not recovering as quickly as other European advanced economies (Germany, France, Italy and Spain) from the COVID-19 Pandemic. The rate of foreign direct investments (FDI) as share of GDP into the UK have seen a drastic decrease since the Brexit referendum result in 2016. The UK was the first major European economy for FDI since the 70s’, reaching the peak in the 90s’, mid 2000s’ and beginning of the 2010s’. Now, it underperforms Germany and Spain.

Another consequent issue that must be discussed when mentioning Brexit trade difficulties is the Northern Irish situation with the implementation of the controversial NI Protocol, a bilateral arrangement between the EU and the UK Government and part of the Brexit Withdrawal Agreement. The Protocol guarantees a check-free border between Northern Ireland and the independent Republic of Ireland. This is possible because although Ulster is not in the EU Single Market anymore, it is still subject to the EU Free Movement of Goods Rules. However, a direct consequence of the Protocol was the creation of a customs border in the Irish Sea, disconnecting Northern Ireland with Great Britain. Since its implementation, the Protocol has been a source not only of political instability, causing the resignations of the First Minister Paul Givan in February 2022, but also of economic and social uncertainties too. For example, between the result of the Brexit Referendum in 2016 and 2019, Northern Irish exports to the rest of the United Kingdom fell by 12% from 60% to 48%. However, half of this share was readdressed to the Republic of Ireland, with a 6% increase in exports from Ulster. And between 2019 and 2021, there was a 31% increase in value of trade between the two Irish nations. It seems that since the beginning of the Brexit chapter in British (and Irish) history, the dependent Northern Ireland and the independent Ireland have become closer than ever.

To summarise, since the end of the Transition Period in January 2021, imports from the EU and exports from the UK have respectively decreased. This economic and political situation has played a consistent role in the increase of food prices accounting a 6% surge affecting the most vulnerable classes. The upsurge in the overall level of prices (and Brexit is not the only reason) has caused inflation to increase to 7% and the interest rate to be set at 0.75%. As a result, the UK has seen one of the slowest recoveries in trade as a share of GDP among the major European economies and the rate of foreign direct investment into the country has fallen to one of its historic minimums since the result of the Referendum in 2016.

Salvatore Ingenito is studying for a degree in Economics with Data Science BSc (Hons)

References

Bank of England (2022). Will inflation in the UK keep rising? [online] BANK OF ENGLAND. Available at: https://www.bankofengland.co.uk/knowledgebank/will-inflation-in-the-uk-keep-rising.

Brexit Caused a ‘Major Shock’ to U.K. Trade Patterns, Study Says. (2022). Bloomberg.com. [online] 25 Apr. Available at: https://www.bloomberg.com/news/articles/2022-04-25/brexit-caused-a-major-shock-to-u-k-trade-patterns-study-says [Accessed 4 May 2022].

Burden, L. (2022a). Brexit Drives Rise In U.K. Food Prices and Lifts Cost of Living. Bloomberg.com. [online] 26 Apr. Available at: https://www.bloomberg.com/news/articles/2022-04-26/brexit-drives-rise-in-u-k-food-prices-and-lifts-cost-of-living [Accessed 4 May 2022].

PIIE. (2022). The UK and the global economy after Brexit. [online] Available at: https://www.piie.com/research/piie-charts/uk-and-global-economy-after-brexit [Accessed 4 May 2022].

The Economist (2022). So close, so far. The Economist, 2 Apr., pp.21–23.