More details will be added closer to the event! Need help accepting your Kent offer? We got you, read the guidance here. Have a … Read more

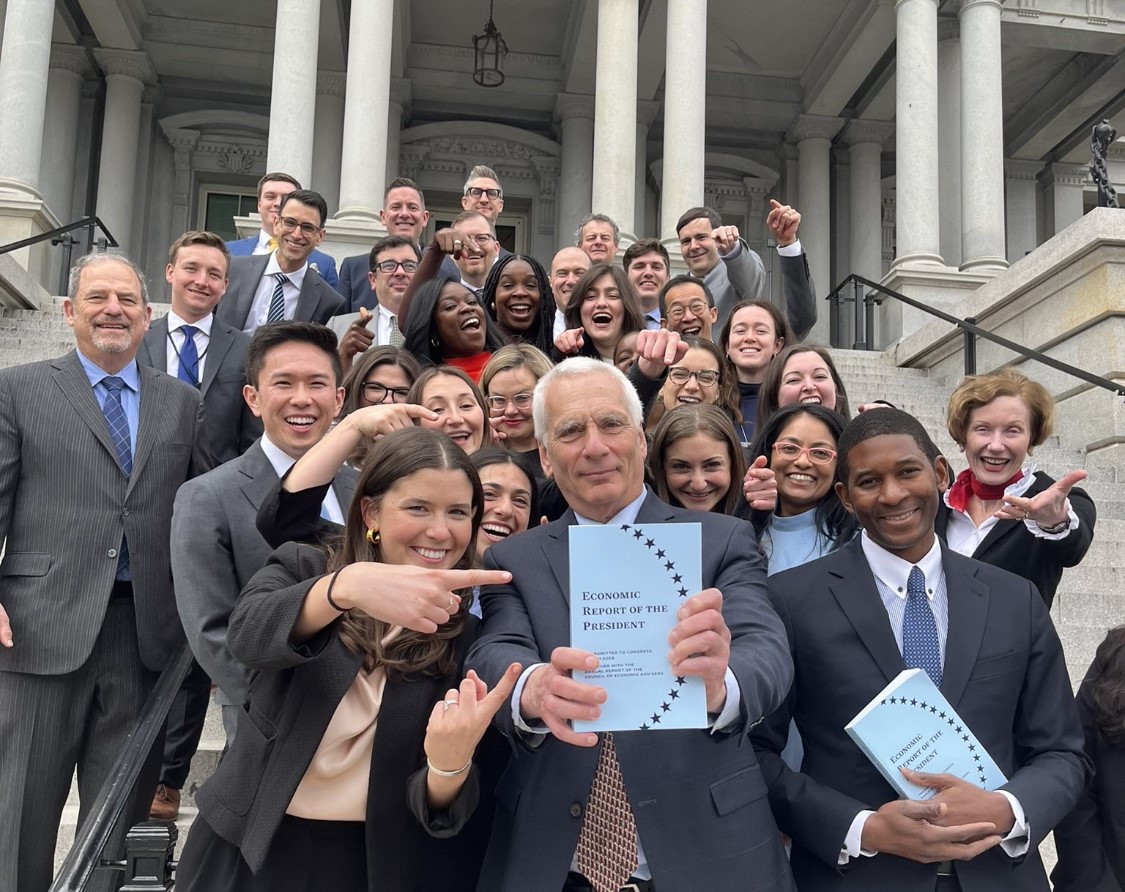

Kent Economics research used to support White House report to Congress

The research of University of Kent Economist, Dr Christian Siegel and Zsófia L. Bárány of the Central European University, Viena have been cited in the … Read more

SLAS Workshop: Referencing and Avoiding Plagiarism

With the help of SLAS (Student Learning Advisory Service), Dr Adelina Gschwandtner and co are running a workshop to help you avoid plagiarism and learn … Read more

In the heart of the Concrete Jungle

Hear from one of our Year in Industry students, who secured his placement at global Investment bank Morgan Stanley. Tom reflected on his experience: “The … Read more

Economics Sustainability Summit

It’s back! After a 2 year hiatus, the Kent Economics Society Summit returns for 2024 with the theme ‘Navigating Climate Change and Sustainability in the … Read more

Reinforcing my faith

Nihad Attab, one of our Professional Degree Apprentices, is studying for her degree over four years whilst apprenticed at Oxford Economics. She also leads on … Read more

Adam Smith and The Bankers: Retrospect and Prospect

Dr Alfred Duncan and Professor Charles Nolan discuss Adam Smith’s vision for banking and try to deduce how Smith might have approached some current issues … Read more

5-weeks Mindfulness course, open to all students.

Learn to deal with feelings of anxiety, improve your ability to focus and foster feelings of happiness and joy. Are you busy living, working or … Read more

Unlocking Success: Inside the Industry with our Placement Students

On Friday 19th January, we caught up with our Year in Industry students at our Canterbury campus! Led by Amanda Gosling, Head of School, our … Read more

Get Stuck into Something Big

Teale Cunningham was part of the first cohort of graduates on our Professional Economist Degree Apprenticeship Scheme and his dissertation has been chosen for inclusion … Read more